Table of Contents

- What Are Netting Escrows & How Does It Work?: The Best Guide - January 2, 2024

- The Secret About Prescriptive Easement: Top Guide 1 Must Know - December 4, 2023

- About Home Equity Loans In Texas And How Can One Obtain It - November 27, 2023

What is Debt To Income Ratio (DTI)

The Debt to Income ratio is one of the most important things when applying for a mortgage after credit score and loan to value ratio.

Understanding the debt to income ratio is significant as it would help you to know how lenders qualify a borrower based on DTI.

Today we will learn the phenomenon of DTI and understand the math behind it.

The Term Debt To Income Ratio

Mostly, your DTI is going to compare what you owe and what you make every month.

It is going to take the amount of money you pay towards your debts every single month and divide that by how much you make every month.

You may have debts like credit cards, student loans, car loans, and any other personal loans. You may or may not have more than one source of income.

If you are employed your paycheck is your primary source of income which you get may bi-weekly or monthly, depending on the terms of the organization you work with.

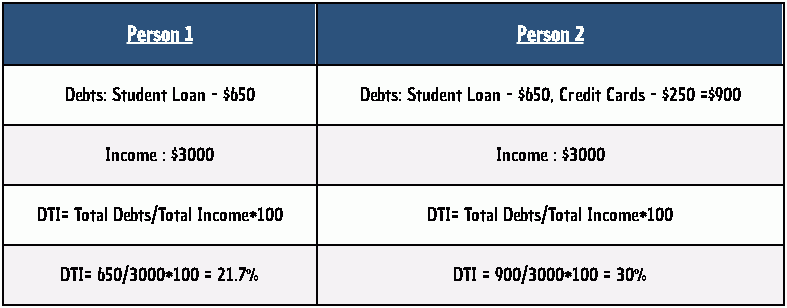

There could be other sources of income as a part-time job, rental income, stocks investment, and capital gains. Below are a couple of examples of how the debt to income ratio is calculated.

Importance of DTI in Mortgages

Lenders are going to use DTI in conjunction with your credit score to make a more realistic picture of you as a borrower.

Not just by how good you were in paying your debts in the past, but also do you have the means to take on additional debt and have enough income to cover it all every month.

Lenders want to see if you have a balance, and you don’t have a ton of debts.

Also, they want to see that your income and your debts are pretty balanced. Lenders would look at how many debts can you afford as opposed to how many debts you are already paying.

If most of your income is going towards your existing debts, a lender might see this as no room left for additional debt, and your loan application may be denied.

When looking at the DTI, lenders know that people with lower DTI have a higher chance to get the desired loan.

If your DTI is low, the lender understands that there is less risk involved and would anticipate your payments accordingly.

Borrowers with low DTI are more likely to make payments with less chance of default.

What is a Good Debt To Income and How to Lower It

Any DTI above 43% the lenders see it as a red flag and won’t lend any more debts if your DTI is above 43%. This ratio depends on the lender to lender and programs to programs.

Some mortgage programs may have a maximum DTI at 55%. And some lenders may consider a maximum DTI at 50%. Any DTI lower than 36% is regarded as an excellent debt to income ratio.

Obviously, the lower the better, but 36% is counted as ideal DTI. Lenders might also consider not more than 28% of it to be coming from mortgage payments.

Hypothetically, let us say your DTI is above the 43% mark, there are only two simple solutions to lower your DTI, make more money, or reduce your debts.

To make more money, you can always work part-time or open a small side business which would help you to not only increase your monthly income but also keep your debts to a minimum.

Any financial advisor will suggest not to get into unnecessary debts. Avoid getting unnecessary appliances, electronics, or any things that do not have a good depreciation value.

This way, you can always keep your debts to a minimum, and making sure you qualify for bigger loans when you actually need it.

Does Debt To Income Ratio Matter?

In your everyday life, probably DTI would not have great importance.

However, if you are planning to borrow money for a mortgage or any other major loan, it might be one of the critical parameters because they would be looking at this number to determine whether or not you get the loan that you need.

Conclusion

When it comes to DTI qualification, your trusted loan officer or mortgage advisor would be the best person to let you know the best possible options available for you.

It would depend on your financial situation to get qualified for the desired loan or mortgage.

Amanda Byford

Amanda Byford has bought and sold many houses in the past fifteen years and is actively managing an income property portfolio consisting of multi-family properties. During the buying and selling of these properties, she has gone through several different mortgage loan transactions. This experience and knowledge have helped her develop an avenue to guide consumers to their best available option by comparing lenders through the Compare Closing business.