Table of Contents

- What Are Netting Escrows & How Does It Work?: The Best Guide - January 2, 2024

- The Secret About Prescriptive Easement: Top Guide 1 Must Know - December 4, 2023

- About Home Equity Loans In Texas And How Can One Obtain It - November 27, 2023

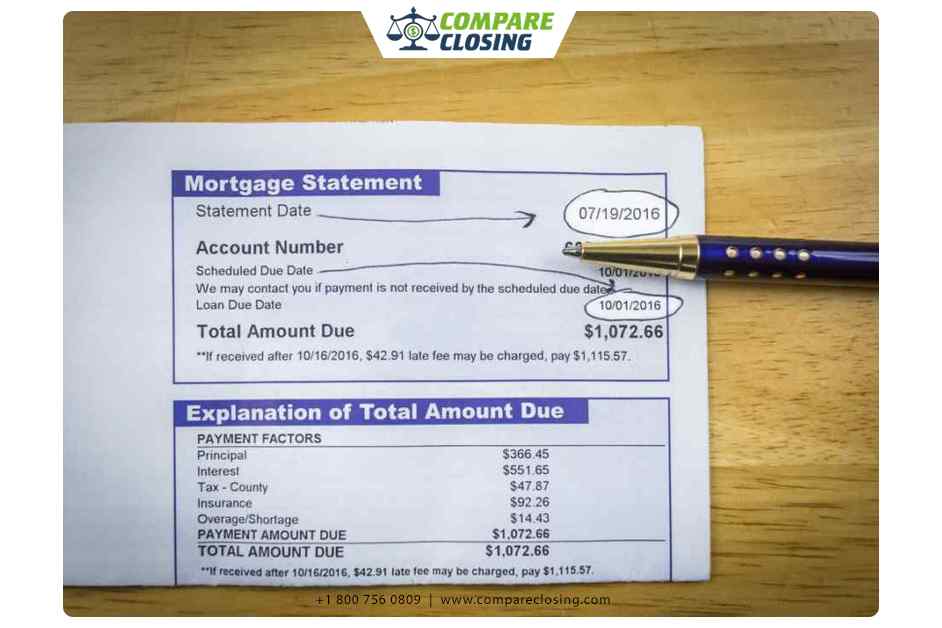

About Mortgage Statement

Once you get a mortgage on your home you may have to keep a track of how much you pay every month and what components are included in your monthly mortgage payments.

To know if everything is going according to your agreement with the lender, you may have to take a look at your mortgage statement quite often.

However, for some people reading a mortgage statement could not be as easy as it looks, especially for first-time homebuyers.

In this post, we will learn what is a mortgage statement and how to read a mortgage statement.

What is a Mortgage Statement?

When you acquire a mortgage your lender will generate a statement for the payments that you have made with the balance remaining on your mortgage and other details is called a ‘mortgage statement’.

This mortgage statement is generated by your lender every month. Your mortgage statement mostly consists of four parts.

The principal, the interest, the taxes, and the insurance.

The principal is the amount that directly goes to paying down your mortgage balance.

The interest is what your bank collects for lending you that money.

This is the so-called profit that they make for lending you the money.

Taxes, for the most part, are your property taxes, and insurance for the most part is your homeowner’s insurance.

In cases where you are getting a mortgage with less than twenty percent down payment, your mortgage statement may also include mortgage insurance depending on which type of loan programs you get.

Why is Reading a Mortgage Statement Important?

For most people, a mortgage or their house is the biggest expense they may have.

That is why it is very important to know where your money is going and how is it impacting your mortgage and how is it reducing every month and every year.

If you don’t understand or don’t plan accordingly, it may have major consequences on your finances.

Hence you must keep a tab on your mortgage statement every month so that you can plan your finances accordingly.

How to Read a Mortgage Statement?

- The first thing that you need to look at is how much is your total monthly payment. For example, your statements show your total monthly payment at $1,253. This is the amount that you have to pay every month to your bank that includes other components like principal, interest, and escrows.

- The next thing that you need to see is principal payment. For example, out of $1,253 principal amount is $233. This means once you make this month’s payment your mortgage balance would be $233 less than last month.

- The interest payment in this mortgage statement example is $352. This is the money that your bank earns for lending you the loan.

- The total principal and the interest amount will remain constant for the entire tenure of the loan. In this example, $233 + $352 = $585 will always remain constant until you pay off or refinance this mortgage.

- As and when you make more payments on your mortgage your principal amount will be more than your interest amount. For example, after say ten years it may look like Principal amount $297 + Interest amount $288 equals $585. In this case, your total PITI remains the same. Every month your principal amount will increase and the interest amount will decrease which means you are paying more towards your principal balance every month.

- The third component that you need to see on your mortgage statement is escrow. An escrow account is an account opened on your behalf by your lender where the property taxes and homeowner’s insurance are collected every month. In our example, they are $668. Your taxes and insurance are due once a year. So the lender will collect the appropriate amount for the taxes and insurance in this escrow account and pay them as and when they are due from this account.

Conclusion

These are the basic things that you need to keep an eye on while you are reading your mortgage statement.

In most cases, your mortgage payments may go up every year. The total of your principal and interest amount will not change.

However, every year your county may assess your property value, and if your property value increases so will your property taxes.

So you need to make sure that you see that change so that you are prepared for your finances and it does not come as a surprise to you.

Amanda Byford

Amanda Byford has bought and sold many houses in the past fifteen years and is actively managing an income property portfolio consisting of multi-family properties. During the buying and selling of these properties, she has gone through several different mortgage loan transactions. This experience and knowledge have helped her develop an avenue to guide consumers to their best available option by comparing lenders through the Compare Closing business.