Table of Contents

- What Are Netting Escrows & How Does It Work?: The Best Guide - January 2, 2024

- The Secret About Prescriptive Easement: Top Guide 1 Must Know - December 4, 2023

- About Home Equity Loans In Texas And How Can One Obtain It - November 27, 2023

Steps to Determine Mortgage Prequalification

Everyone knows who to talk to if they are looking to buy a home.

There is a procedure that begins by you getting in touch with your loan officer, providing some information, and the loan officer running your credit and following with some number as mortgage prequalification.

In this post, we will learn how to determine mortgage prequalification by yourself and what is the calculation behind it.

Just to make sure that we start with an honest note, this would not be an actual mortgage prequalification. This is just for you to gauge how much can you pre-qualify for? and how the numbers are derived.

The mortgage prequalification calculation is complicated. Tons of layers, scenarios, and situations are considered that might differ from person to person and lender to lender.

If you want to understand the mortgage prequalification calculation, you may want to divide them into three categories.

These are your credit score, your job history, and your debt to income ratio. You have to have all three boxes checked and qualified.

You can’t have a situation where you have phenomenal credit, perfect debt to income ratio but you don’t have the credit history for the house that you are looking for.

This also applies to any co-signer, if you are in a situation where your credit is not up to the mark, but you have the work history and the debt to income ratio in place.

Credit

First and foremost, you want to know what kind of loan program you are going to qualify for.

First, you need to determine how long you are going to live in the house. If this is a short term house, you might want to go for FHA because the mortgage insurance is higher, and the interest rates are lower.

You can go for a conventional loan if you are planning to stay in the house for ten to fifteen years or even longer. You can check your score online through many websites like credit karma, Transunion, Equifax, or Centurion.

P.s. you might not get the perfect credit scores with some of the online sites. The idea here, however, is to get to know your approximate credit score.

The lenders pull your credit from all the three credit bureaus and consider your median score for mortgage prequalification.

For FHA, you need a minimum credit score of 620. For a conventional loan, the minimum credit score required is 640. If you have a credit score above 720, you might as well go for a traditional loan to enjoy more benefits.

If you are using down payment assistance programs, you would want to make sure that your credit score is at least in the mid to high 600s so that you can get some more down payment assistance and a little lower interest rates.

Job History

If you are a W2 employee, you get paid a salary on an hourly wage; at the end of the year, you get a W2. The first best-case scenario is if you have been at the same job or career for more than two years.

For example, if you are an electrical engineer with the same company for at least two years, that would be considered as the best-case scenario.

The second best-case scenario is you have at least over a total of two years of job history. Even if you did switch jobs or switch career paths as long as you are W2, they would like to see at least six months in the new career or job.

For example, if you worked as an electrical engineer for 18 months and then decided to work for an insurance firm and you are still W2, that is something that a lender might consider with a total of two years of job history with a new job history of at least six months.

If you are 1099, which means you are self-employed or some contractor, it makes mortgage prequalification simpler and straight forward. In such a case, you would need two years of tax returns with that same paying job.

The unfortunate part is they use the average of both years’ income to predict how much you are going to qualify for.

For example, if you have netted $ 50,000 last year and 100,000 this year, your average annual income would be considered as $75,000.

The Debt to Income Ratio

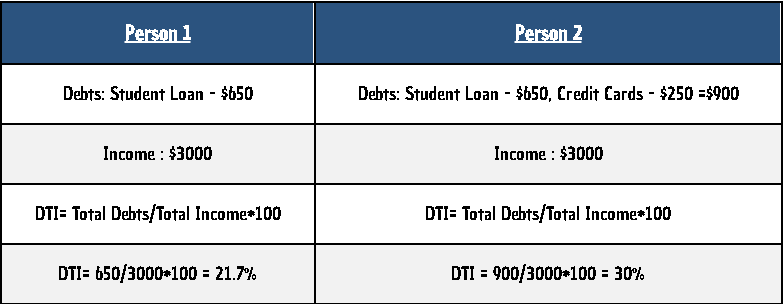

To calculate your debt to income ratio, you have to add up all your minimum monthly payments like credit cards, auto loans, or any other personal loans that you might have. These are all the obligations that pop up on your credit.

That equation gets added to the monthly payments that you are qualified for. And divide that by your monthly gross income. The total DTI should not exceed 45% to be on the safer side. Some loan programs might go up to 50% DTI.

However, to be on the safer side when you are calculating your DTI, it should be 45% or below. You can also use an online mortgage payments calculator to anticipate your monthly payments based on some necessary information.

Conclusion

You have three checkboxes that you need to have ticked to know your mortgage prequalification.

And if you check-marked each one, your credit score, your job history, and your debt to income ratio, you are good to know what is your mortgage prequalification.

If any one of those boxes is unchecked, you might want to work towards that category so that you pre-qualify for your home purchase.

Amanda Byford

Amanda Byford has bought and sold many houses in the past fifteen years and is actively managing an income property portfolio consisting of multi-family properties. During the buying and selling of these properties, she has gone through several different mortgage loan transactions. This experience and knowledge have helped her develop an avenue to guide consumers to their best available option by comparing lenders through the Compare Closing business.