Table of Contents

- What Are Netting Escrows & How Does It Work?: The Best Guide - January 2, 2024

- The Secret About Prescriptive Easement: Top Guide 1 Must Know - December 4, 2023

- About Home Equity Loans In Texas And How Can One Obtain It - November 27, 2023

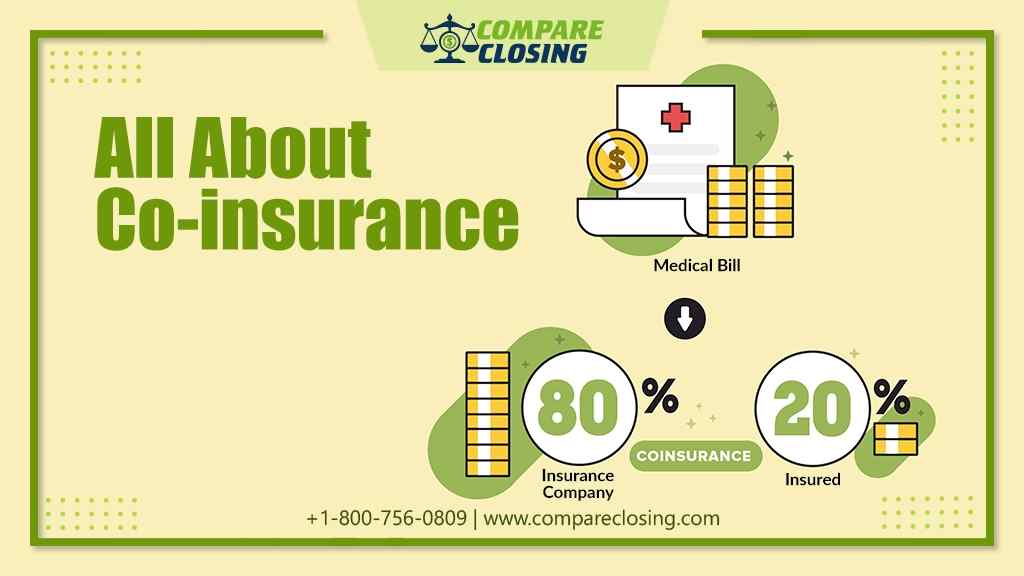

About Co-Insurance

When you have any medical emergency, many people keep themselves prepared with health insurance.

Similarly, when you buy a property, you get homeowner’s insurance. There are many types of home insurance available for homeowners.

In this post, we would be learning about what is co-insurance and how is it calculated.

What Is Co-Insurance?

Coinsurance is basically how insurance companies make sure that you are insuring your property to close to what it costs to rebuild and replace it.

It is called coinsurance because it describes what happens if your property is not insured to its correct value.

You will become responsible for the portion of the claim, which means that you become a co-insurer.

All property policies have co-insurance whether it is built into the coverage like homeowner’s insurance are specifically described on a commercial property insurance policy.

The coinsurance is described by a percentage of the value to rebuild the building or replace your contents.

Usually, eight or ninety percent or some have a hundred. If you have eighty percent coinsurance then you have to ensure at least eighty percent of the building or the value of the contents.

If you don’t insure your property to the correct coinsurance percentage then the company will deduct from the claim the same percentage that you were underinsured.

What If I Am Under-Insured According To The Co-Insurance Clause?

One percentage is the amount you promised to ensure, for example, if your property costs around $200,000 to rebuild and you have an eighty percent coinsurance clause, then you promise to ensure at least $160,000.

The other percentage is the amount the company will deduct from the claim because you were underinsured.

Figuring out the percentage that they deduct is also called the penalty which requires a little math.

You will take the amount that is insured, divide it by the amount that you should have insured then multiply it by the amount of the loss.

In our example, if you have insured $120,000 instead of $160,000 and your property suffers a loss of $100,000 then you can calculate the penalty as given below:

120000 / 160000 * 100000 = 75000

Also, keep in mind that they will also subtract the deductible from the answer. The difference between what the loss was and what the carrier will pay before the deductible is the coinsurance penalty.

So in this example, the coinsurance penalty is $100,000 – $75,000 (less the deductibles) which equals $25,000/-.

The company will deduct from the loss whatever percentage that you were underinsured.

In this example, you were underinsured by twenty percent, so the company will deduct twenty percent from the loss.

Can A Homeowner Decide The Coinsurance Amount?

If you are wondering why this property insurance works this way, and why can’t you just insure for whatever value you want without penalty.

The answer has to do with the statistics that the carriers use to try to figure out how likely a property is to have a loss.

It is much more likely for a building to have a $100,000 loss when it is worth a million dollars than a building that has a $100,000 loss when it’s a hundred thousand dollar value.

Co companies use coinsurance to make sure that they are collecting enough premiums and have enough money to pay the claims that they are likely to have in any given twelve-month period.

How To Determine If Right Value is Been Co Insured?

It pays to make sure that you have your property insured to the correct amount so that you get the loss paid the way you expect it when it matters the most.

You can make sure that you are insuring to that value by having a replacement cost appraisal performed on your property or having an updated list of your stock and equipment with all the values that you paid for them.

Keep in mind that not all insurances are created equal. This is just a broad and general explanation of how co-insurance works on property insurance policies.

Conclusion

Some policies have endorsements that can take away more coverage or even add coverage.

No matter what you may see on any advertising channels, not all policies are the same.

It is suggested to spend some time with your independent insurance agent and discuss your coverage and make sure that the insurance coverage you want to have is what you would have covered on your property insurance policy.

Amanda Byford

Amanda Byford has bought and sold many houses in the past fifteen years and is actively managing an income property portfolio consisting of multi-family properties. During the buying and selling of these properties, she has gone through several different mortgage loan transactions. This experience and knowledge have helped her develop an avenue to guide consumers to their best available option by comparing lenders through the Compare Closing business.