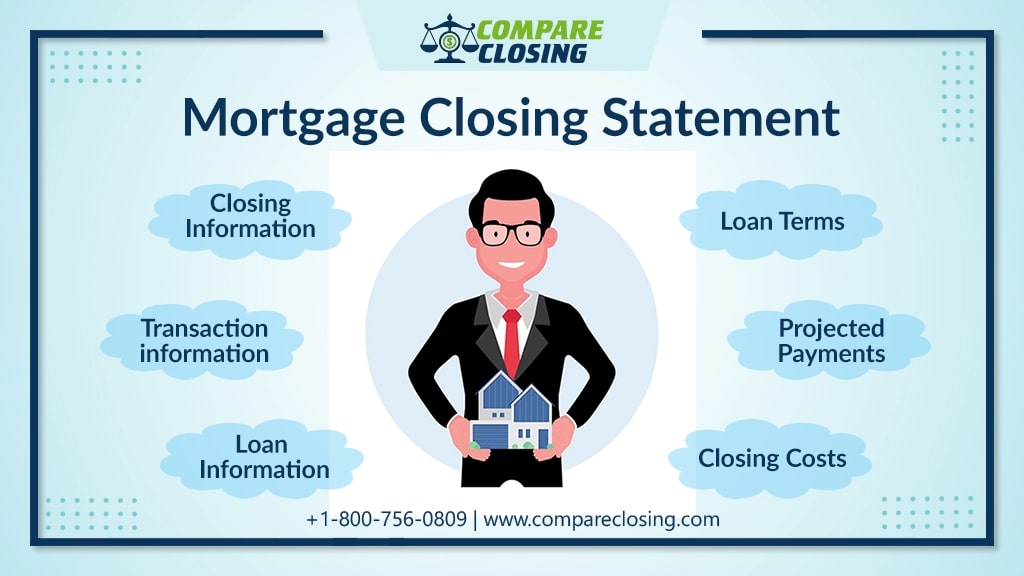

This section shows the total amount of closing costs and the cash to close required to complete the transaction.

The rest of the closing statement will include all the charges and costs in detail like Origination charges, points, appraisal fees, credit report fees, Flood Cert. fees, tax service, processing fees, title charges, recording charges, Prepaids, and others.

This section will also inform what fees are to be paid at closing and what are to be paid before closing.

The closing statement will also have all the contact information about the lender, mortgage broker, real estate agent, and the settlement company so that you can contact them in case you require any documents from them.