Gross wages are the total sum of money the employer owes an employee before they take out any taxes and deductions. If an employee has any nontaxable income, that also gets added under gross wages.

The calculation of the employee’s gross wages depends on whether they are paid hourly or salaried.

In the case of hourly workers, the employer multiplies the employee’s hourly pay rate with the number of hours worked.

For a salaried worker’s gross pay, the employer divides their annual salary by the number of pay periods in the year.

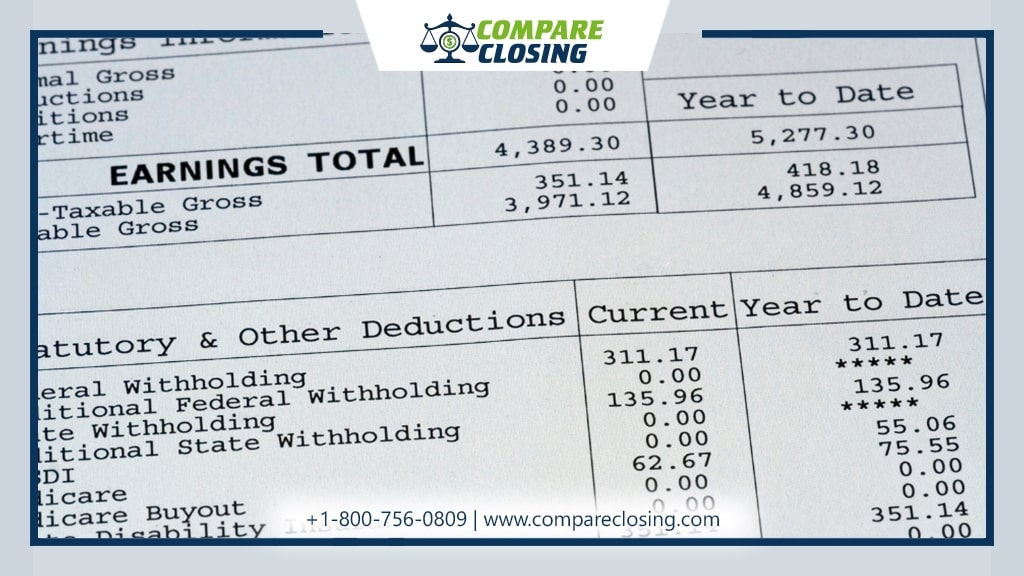

The pay stub gives gross pay information in two columns: current gross pay and year-to-date gross pay

Along with that an employee’s gross pay portion of the stub also includes –

- The total number of hours worked: Pay stubs for hourly and nonexempt salary workers should have the number of hours worked. Nonexempt employees can work regular, overtime, and double-time types of hours. the pay stub should include the total hours for each type of hour. On the pay stub, make sure each kind of hour worked should be on its own line. Salaried employees’ hours may be recorded on their pay stubs, though it’s not mandatory. The hours worked into current and year-to-date columns must be separate.

- Pay rate: The employers should include the employee’s pay rate on their pay stub. For hourly workers, each employee’s hourly pay rate must be noted. In the case of a salaried worker, they need to show the salary amount of pay for the pay period worked. Also, they need to record the employee’s separate pay rate on the pay stub if they have worked overtime, double-time, etc.

- Employee taxes: The gross pay amount is not taken home by the employees. Their earnings get reduced with payroll taxes and other deductions. The taxes are itemized in the pay stub so the employees can see all the tax amounts withheld from their gross pay.

The standard employee payroll taxes included in the pay stubs are:

- On the pay stub, a separate line is created for each tax, showing the amount withheld for the current pay period and year-to-date. The paystub also has separate Federal income tax

- The employee portion of Social Security and Medicare taxes

- State income tax

- Local income tax

- State unemployment tax if they belong to Alaska, New Jersey, and Pennsylvania

- State- and local-specific taxes

- Employee-paid taxes from the employer-paid taxes mentioned.

“An excellent breakdown of pay stubs’ significance for both employers and employees. This article covers all aspects, from gross wages to deductions, offering a comprehensive understanding of payroll. And for small businesses, SecurePayStubs is a game-changer. Their service streamlines pay stub creation with accurate tax calculations, making payroll management effortless. A must-read for anyone seeking efficient payroll solutions. 💼📝 #PayrollExcellence #SecurePayStubs”