Table of Contents

- What Are Netting Escrows & How Does It Work?: The Best Guide - January 2, 2024

- The Secret About Prescriptive Easement: Top Guide 1 Must Know - December 4, 2023

- About Home Equity Loans In Texas And How Can One Obtain It - November 27, 2023

About Vantage Score

When you are applying for any credit product or service, the lender is required to check your credit score before providing the loan or service.

When it comes to getting credit scores there are two types of scoring companies FICO and VantageScore. In this post, we will understand what is a VantageScore in detail.

What Is A Vantage Score?

The vantage score is a credit scoring system created by the top three credit rating agencies namely TransUnion, Equifax, and Experian in 2006 as an alternative for FICO that was created by Fair Isaac Corp.

In 1989. Just like FICO, vantage credit scores help creditors and individuals to know and analyze credit scores based on various factors.

This scoring system is designed to provide a consistent credit scoring system that can be used by all three credit rating agencies.

This score is very useful for new immigrants and students who want to know their credit standings without any cost.

How Is Vantage Score Derived?

The latest version, VantageScore 4, is a credit score calculated from the average of five weightings.

- Total available credit, credit balance, and credit usage.

- Credit history age

- New Credit accounts opened

- A mix of credit and experience

- Repayment history

It uses advanced machine learning techniques and complex algorithms that claim to be more accurate than FICO scores. Many important factors were not included in the calculation, such as “race, sex, color,

salary, marital status, religion, age, housing, place of employment, total assets, national origin, work history, and occupation”.

In the earlier version of this scoring system, the scores ranged from 501 to 990 and were provided with grades corresponding to the score from A to F.

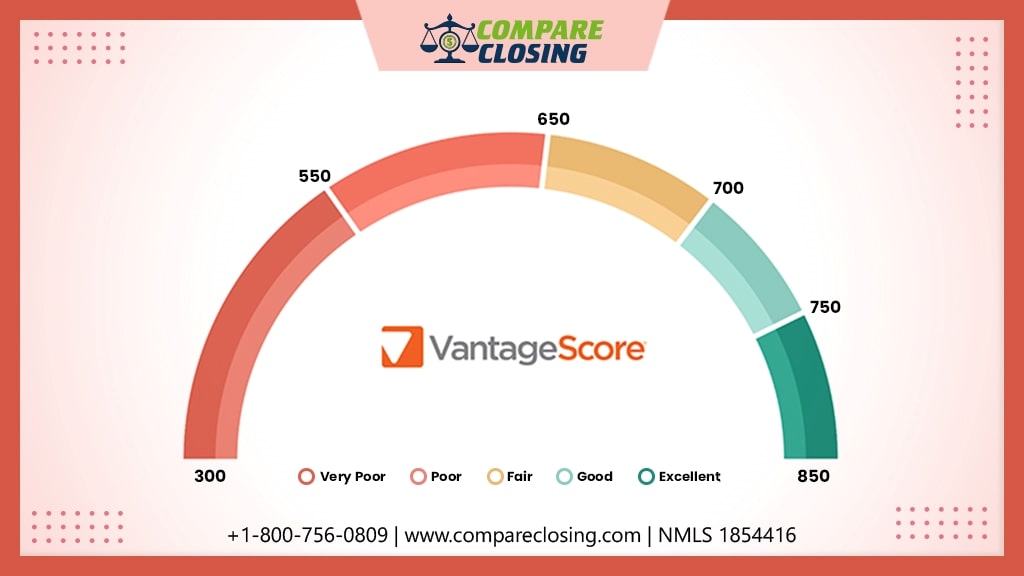

In the VantageScore Version 3, the grading system was removed and the scoring range was changed to 300 to 850 just like FICO.

The FICO score is still the most popular credit scoring system used by about 90% of all lenders and banks.

Being said that, according to experts the vantage credit scoring system has gained popularity since June 2015 and is growing at a rate of 20% every year.

A recent study looking at the year from July 1, 2018, to June 30, 2019, found that over 2,500 users used around 12.3 billion credit checks through this scoring system.

During this period credit card companies were the top users of this scoring system after the banks.

What Is The Difference Between Vantage Score Vs FICO Score?

It takes less time to set up a VantageScore compared to a FICO score. A consumer can get a vantage credit score within 1-2 months of opening a credit account, whereas, FICO requires at least 6 months of credit history.

Hence, individuals that are unable to get a FICO score due to less than 6 months of credit history are still eligible to get a vantage credit score.

- Vantage scoring system ignores accounts that are paid in collections

- Vantage scoring system will have a higher negative impact on credit score for late mortgage payments compared to late payments on other debts. However, in both situations, the credit score is negatively impacted.

- VantageScore will allow individuals with only 14 days while shopping for mortgage or auto loans, compared to 45 days for FICO scores. (Multiple inquiries will be considered as one in the case of VantageScore if done within 14 days).

- Vantage scoring system will also be considerate for individuals affected by natural disasters.

Conclusion

The most common question asked by the individuals is, what is it a good vantage score? A good vantage score is anywhere above 660.

You can check your vantage score from many online websites to get an estimated vantage

credit score. However, the majority of lenders and banks still prefer FICO to qualify the borrowers that apply for credit.

Amanda Byford

Amanda Byford has bought and sold many houses in the past fifteen years and is actively managing an income property portfolio consisting of multi-family properties. During the buying and selling of these properties, she has gone through several different mortgage loan transactions. This experience and knowledge have helped her develop an avenue to guide consumers to their best available option by comparing lenders through the Compare Closing business.