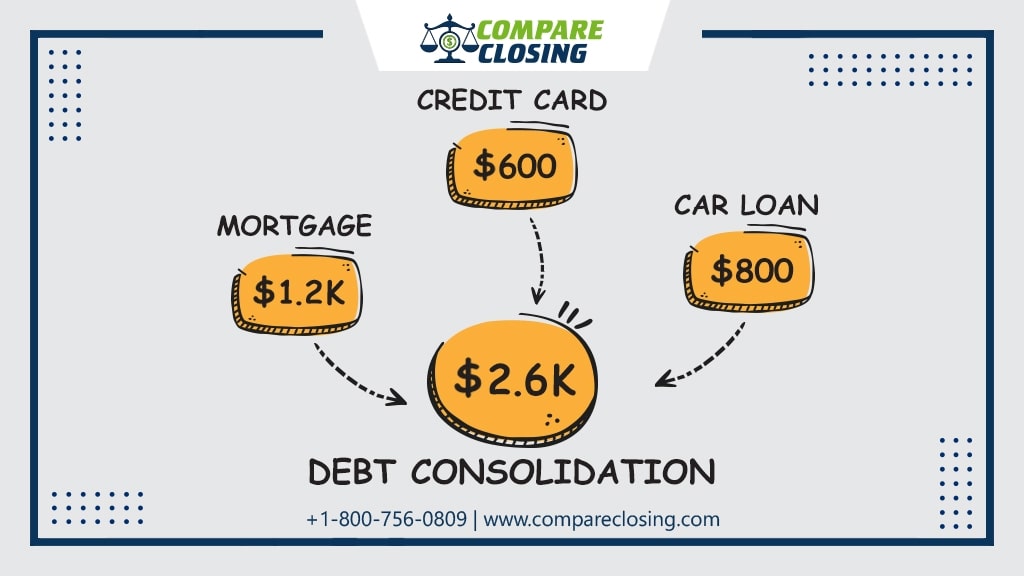

When different forms of financing are used to pay off other debts and liabilities that process is debt consolidation.

If a customer is weighed down with different kinds of debt, they can apply for a loan to consolidate those debts into one single liability and pay them off.

Money then goes towards the payment of the new debt until it is paid off in full.

As their first step for a debt consolidation loan most people apply through their bank, credit union, or credit card companies.

If the borrower has a good relationship and payment history with their institution then the process would be easier. If they’re turned down, they can try with private mortgage companies or lenders.

Many creditors are ready to go ahead and do this because debt consolidation maximizes the possibility of payment from a debtor.

Financial institutions such as banks and credit unions usually offer these loans, but these services are also provided by other specialized debt consolidation service companies to the general public.