Table of Contents

- What Are Netting Escrows & How Does It Work?: The Best Guide - January 2, 2024

- The Secret About Prescriptive Easement: Top Guide 1 Must Know - December 4, 2023

- About Home Equity Loans In Texas And How Can One Obtain It - November 27, 2023

About Shared Appreciation Mortgage (SAM)

When you apply for a mortgage to buy a home, typically the lender will charge you an interest rate according to the current mortgage prime rate you qualify for based on your credit and income.

However, there is an option where you could be offered substantially low interest with the help of a shared appreciation mortgage. In this post, we will learn what is a shared appreciation mortgage (SAM) in detail.

What Is A Shared Appreciation Mortgage?

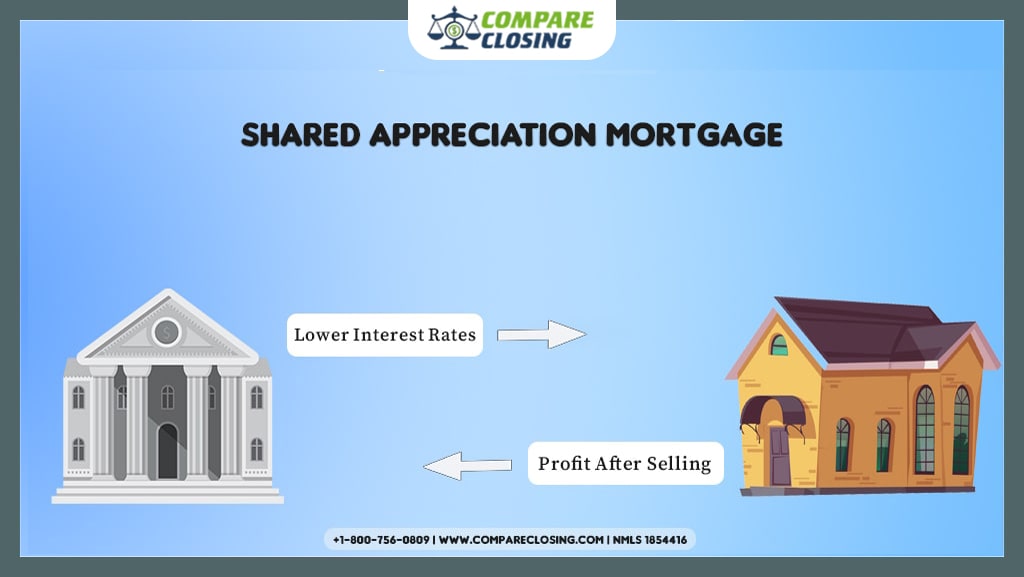

A shared appreciation mortgage, also known as SAM, is a mortgage loan where the lender offers an interest rate below the current prime rate in exchange for a share of the profits when the property is sold by the homeowner.

In this type of mortgage, the borrower needs to pay off the mortgage within a specific time.

It completely depends on the growth of the housing market to determine whether SAM is a good option.

In a market where house prices rise in the long run, it is usually not a good deal for the borrower because they still owe the outstanding principal if the value of the property falls.

On the other hand, if the borrower sells the property at a loss, the proportion of the appraised value called contingent interest will be zero.

Shared appreciation loans are also used by nonprofit organizations and governments.

They are structured as second mortgages, but borrowers don’t pay until they sell the property or refinance the first mortgage.

After the sale or refinancing, the borrower must repay the entire loan amount, plus part of the house price that was appreciated.

For example, let’s assume a borrower who bought a home for $190,000 with a loan of $152,000 and down payment of $38,000 at a below prime interest rate from a lender and agreed to pay 30% of the appreciated property value to the lender after 10 years.

Let’s assume after 10 years borrower paid off the mortgage amount of $152,000 and the property value was appreciated to $320,000.

This means the property value increased by $130,000 in 10 years. The borrower would have to pay $39,000 (130,000 x 30%) to the lender as 30% of the appreciated value according to the SAM agreement.

When To Consider Getting A SAM?

The biggest source of wealth for individuals and families in the U.S. is the appreciation of their property values.

Then why would someone share their wealth with the bank or a lender by getting SAM?

The answer is simple, in exchange for the shared appreciation value, the borrower will be getting the interest rate that he or she may otherwise be unable to qualify for. This will make their homeownership more affordable.

In a regular mortgage process, the lender will qualify the borrower and provide an interest rate based on the credit score, loan-to-value ratio, and current market condition.

However, for borrowers who have a weaker credit score or don’t have the money for a larger down payment, a SAM may be an option to get a more manageable mortgage payment.

There could be various parameters and contingencies in a shared appreciation mortgage that a borrower might find less interesting.

For example, there could be a phase-out clause in which the lender will collect an extra amount from the borrower if the borrower is unable to refinance or sell the property within the time specified in the SAM agreement.

This is so that the lender can recoup its share of the appreciation through these additional payments.

Conclusion

A shared appreciation mortgage is a great option for individuals that are looking for low-interest rates and more affordable monthly mortgage payments.

However, you may also need to consider that you would be sharing a huge chunk of your wealth with the lender if the property value is appreciated significantly.

On the other hand, if the property value drops drastically, you may still have to make provisions to pay the lender its share which means less profit for you.

Amanda Byford

Amanda Byford has bought and sold many houses in the past fifteen years and is actively managing an income property portfolio consisting of multi-family properties. During the buying and selling of these properties, she has gone through several different mortgage loan transactions. This experience and knowledge have helped her develop an avenue to guide consumers to their best available option by comparing lenders through the Compare Closing business.