An Amazing Guide To Zoning & List Of Categories One Must Know

- Home

- Resource

- Compare Mortgage Quotes

COMPARE MORTGAGE QUOTES

Whether you are planning to buy a new home or refinancing your current one, when it comes to mortgages, getting one could be confusing. We would always want to get the best deal from the lender. But how would we know if the one that we are getting is the best deal in the market? Well, to answer that question we need to make sure that we shop around, and how do we shop around? By Comparing mortgage quotes. There are some basic steps to compare mortgage quotes to get the best out of the market.

Decide how many lenders you want to speak with

Make sure that you decide how many mortgage lenders you want to speak with before getting any quotes so that you can compare mortgage quotes more efficiently.You may want to speak to at least three lenders to get the best deals out of the market and increase your negotiation power. Speaking to too many lenders can create confusion and might affect your ability to make an informed decision.

You can also get information from Google to check which lender is doing great in your area and approach the best ones after checking their reviews. Once you have made this decision you are ready to get and compare mortgage quotes and analyze them. Different lenders will provide you different quotes, interest rates, and fees. The difference in interest rates may not be huge, hence you might want to focus on fees because the whole transaction should make financial sense and should be worth your money.

Compare mortgage quotes on the same day

The bond market plays a major factor in how banks and mortgage companies price, fixed rates and costs. Sometimes economic news like FED decisions, job reports, and trade news can impact mortgage rates during the day. Due to this, the mortgage rates fluctuate every day, sometimes more than once in a day.

So, if you plan on talking to a couple of different lenders, see what each is offering on the same day and then make your decision. According to the Consumer Financial Protection Bureau (CFPB), Onan average a borrower is able to save approximately three hundred dollars every year just by comparing mortgage quotes from three lenders.

However, you don’t have to limit yourself to that number. Since getting a mortgage quote from a lender is free, you can get as many as you want. You may want to get and compare mortgage quotes on the same day because the interest rates change on daily basis. You want to give the lenders a fair chance of competing for your business.

Is comparing rates your priority?

Once you have received mortgage quotes from the lenders, its now time to compare. Your primary intention of comparing mortgage quotes is to save money. And you will rightly do it with aligning the lender with the lowest interest rate first. However, one thing to know is that rate is not the only thing that you need to look at while comparing.

There might be a lender who is offereing you the lowest rate however, you might have to pay discount points to get that rate. Or a lender who is offering you a little higher rate but is helping you to get the minimum closing cost. Make sure you compare the loan estimate or the fees worksheet that you received from the lender wisely and properly. Getting the lowest interest rate might not always mean that you are saving money.

Why use Compare Closing For Comparing Mortgage Quotes?

When it comes to comparing mortgage quotes with compare closing, you can be assured that you are in safe hands. Compare Closing LLC is a company that is affiliated with top tier lenders and brokers and can compare mortgage quotes for you. You don’t have to go through the pain of finding the lenders, speaking to them individually and going through the entire comparison process. All you need to do is get the mortgage quotes and call us or use our online compare mortgage quotes calculator to understand which lender is offering you the best deal. Moreover, if any of our lending partners are able to offer you something better than what you have received we will also provide our quote and let you know the best that our preferred lenders can offer. So why wait? Your next mortgage deal is just a phone call away. Remember, when lenders compete for your business you will be the one to reap all the benefits.

Related Blog

What Is The Rule Of 78 And How Does It Work?: Supreme Guide

When you take any loan the lender will charge interest on the amount that you have borrowed. If you are thinking of getting a short-term loan, you should be aware of this term known as the rule of 78. In this post, we will understand what the rule of 78 is and how is it calculated.

What Is Real Estate Settlement Procedures Act? – The Top Guide

When purchasing real estate, there are many laws that a lender has to follow to close on a mortgage. One such law is called the Real Estate Settlement Procedures Act (RESPA). In this post, we will understand what it is in detail.

What Is A Tri Merge Credit Report? – The Significant Details

When you apply for a mortgage your credit report plays a significant role in qualifying you for that mortgage. In this post, we will understand what is a tri-merge credit report in detail.

Ultimate Guide About Lease Option With Its Pros And Cons

When you are looking to buy a home there are a lot of things that a buyer needs to be prepared with like a good credit score, down payment, and commitment to ownership. However, what if you don’t have a credit score that could qualify you for a mortgage?

What Is Fair Credit Reporting Act (FCRA)? – Expert Overview

Many consumers may not be aware or just beginning to become aware of the power and influence that these credit bureaus have over the market. In this post, we will understand what is the Fair Credit Reporting Act (FCRA) in detail.

All About ESCROW FEE – A Comprehensive Guide One Must Know

There are a lot of costs included in a real estate purchase transaction. Different departments work diligently to make sure that your transaction is completed on time.Before we jump into escrow fees let’s first understand escrow and escrow accounts.

What Is Carryback Loan? And Find Its Major Pros And Cons

For a home buyer or an investor buying a real estate property is one of the largest purchases they will be doing. However, there is an option that some sellers may provide called a carryback loan. In this post, we will learn about what a carryback loan is in detail.

About Comparable (COMPS) in Real Estate: An Expert Guide One Should Know

When you are planning to buy a home, your real estate agent will show houses on sale with their listing price. This happens with the help of comparable properties. In this post, we will understand what are comps in real estate in detail.

What Is a Credit Bureau and What Is The Importance Of It?

Credit plays a very significant part in an individual’s life. In today’s world, we cannot imagine our life without accessing or requiring some sort of credit. In this post, we will learn details about what are credit bureaus and how they function.

What Is A Real Estate Attorney And The Best Way To Find One?

When you are buying or selling a property, there are many legal terms included in the transaction that a buyer or a seller might not be aware of. A home purchase is a legal transaction where the title of the home is transferred from one person to another.

What is Joint Tenancy? – The Detailed Overview With Pros and Cons

When you are buying a new home, as long as there is more than one owner in the property, you are required to indicate the type of your ownership. In this post, we will learn what is joint tenancy? And its pros and cons.

A Top Guide To Abstract Of Title – How Can One Obtain It?

When you buy a piece of property, and the period between contract and closing, there are a lot of things that are done to ensure that the new buyer is getting a property according to his expectations.

What is Accrued Interest and How Does Its Calculation Work?

Everyone knows that when you get any loan whether it be a personal loan or a mortgage when you repay, the lender or the bank where you got the loan from will charge you interest on the amount that you borrowed.

What Is a Preliminary Report and What Are the Importance?

If you are looking to purchase or sell a property, there are many documents that you have to go through. Every document is important. However, there is one of the documents that is as significant as others. This is called a preliminary report.

What Is Credit Rating And Why It Is Importance For Borrower?

When it comes to lending, an individual’s credit plays the most significant role in terms of loan qualification and availing the best loan terms. Credit rating is just a score that evaluates the quality of the business, government, or individual and judges them on their ability to repay the debt on time.

Co-signer vs Co-borrower – The Best Guide One Should Know

When you need to buy a new house and if you think that your credit scores or income are not enough for you to qualify on your own to purchase the said property that you are interested in. In this case, you are interested in considering the option of co-signer or co-borrower. In this post, we will learn the difference between co-signer vs co-borrower.

Ultimate Guide To RTC And Its Advantages And Disadvantages

The Resolution Trust Corporation (RTC) is an old temporary federal agency that was in function from 1989 to 1995. It generally settled the Savings and Loans(S&L) emergency of the 1980s.The RTC covered a sum of 747 failed organizations, with complete assets of $394 billion. It additionally sold the assets of these establishments.

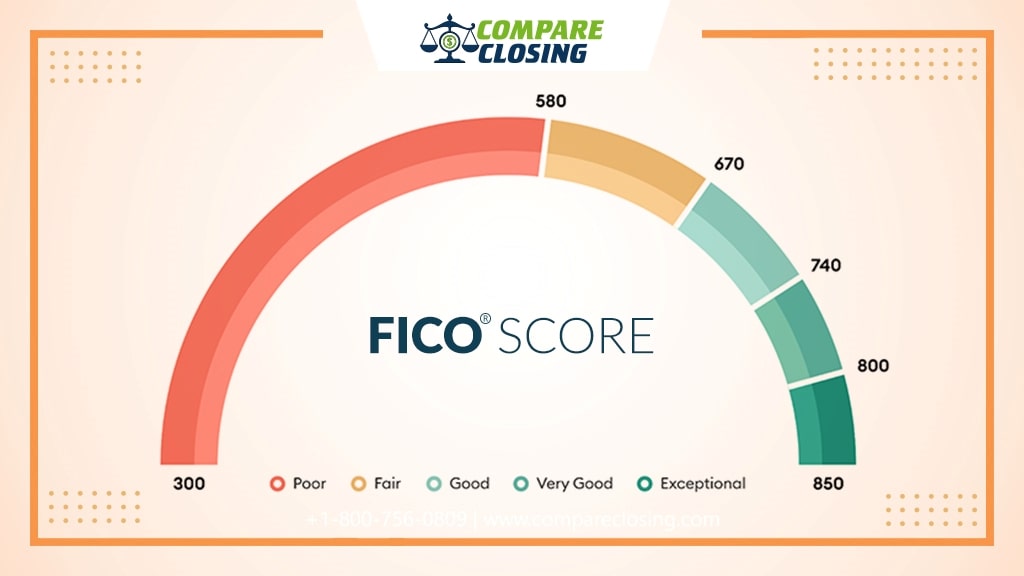

What Is a Fico Scores And What Are The Significance Of It?

Most of you know what credit scores are. Did you know that most lenders consider FICO scores when it comes to lending? In this post, we will learn more about FICO scores and their importance.FICO stands for Fair Isaac Corp. This was introduced in 1989. This type of score is widely used by all the lenders in the mortgage industry to qualify an individual based on his or her credit score.

Guide to Ginnie Mae: How Does it Work and What Does it Do?

Ginnie Mae is a federal government corporation, which guarantees the timely payment of principal and interest on mortgage-backed securities that are issued by approved lenders. Ginnie Mae is the common name for the Government National Mortgage Association and is abbreviated to GNMA.

What Is A FED Discount Rate And Why It Is Important?

The interest rate set by Federal Reserve (Fed) on loans extended by the central bank to commercial banks or other depository institutions is termed as the FED discount rate.

(GSE) Government Sponsored Enterprise: Top Guide 1 Must Know

To enhance the flow of credit to specific sectors of the American economy a government-sponsored enterprise (GSE) got established. A GSE is a governmental entity, which was created by Congress, even if these agencies are privately held they provide public financial services.

What Is Monetary Policy?: Unlock The 2 Important Types Of It

Monetary policy is a set of tools built with the intention of promoting sustainable economic growth. A country’s central bank promotes these tools by controlling the overall supply of money that is available at the nation’s banks, its consumers, and its businesses.The sole intention of a monetary policy is to keep the economy pulsing along at a rate that is consistent.

Mortgage Origination Fees – What Is it & Who Have to Pay It?

An upfront fee that is charged by a lender to process a new loan application is a mortgage origination fee. In the United States of America, these loan origination fees come anywhere between 0.5% and 1% of a mortgage loan amount and they are always in the percentage of the total loan.

All About Non Conforming Mortgage – Is It The Better Choice?

A mortgage that does not meet the guidelines of government-sponsored enterprises (GSE) like Fannie Mae and Freddie Mac and, hence cannot be sold to them is a non-conforming mortgage. A non-conforming mortgage is the opposite of a conforming mortgage.

What Is Owner’s Title Insurance And Why One Must Need It?

In the journey of home buying, many times people are only saving up for their down payment and are not aware of many things that they will have to purchase.An owner’s title insurance is one of the most important purchases that a purchaser must make.

What Is A Credit Union And How Does It Work? – The Complete Overview

Credit unions are financial institutions, which are similar to banks but here the members own the credit union. They are nonprofit establishments with the aim of serving their members rather than seeking business and earning profit.

4 Steps Mortgage Shopping Tips for First Time Homebuyers

Today let us discuss one of the most important topics in the home buying and refinancing experience. So below are the 4 simple steps you can consider to shop for the best mortgage deals.

4 Effective Ways To Select The Right Mortgage Lender in Texas

If you are looking to get a mortgage or to refinance your existing mortgage, you might want a loan officer who can assess your situation and suggest the best mortgage loan according to your requirements.

6 Best Mortgage Loans: Find The Best One To Suit Your Needs

Buying a home is every American’s dream, finding the right property and choosing the best mortgage loans type is in itself tedious work. As the borrower will be paying back their mortgage for a long period of time, it is important for them to find a loan that meets their requirement and budget.

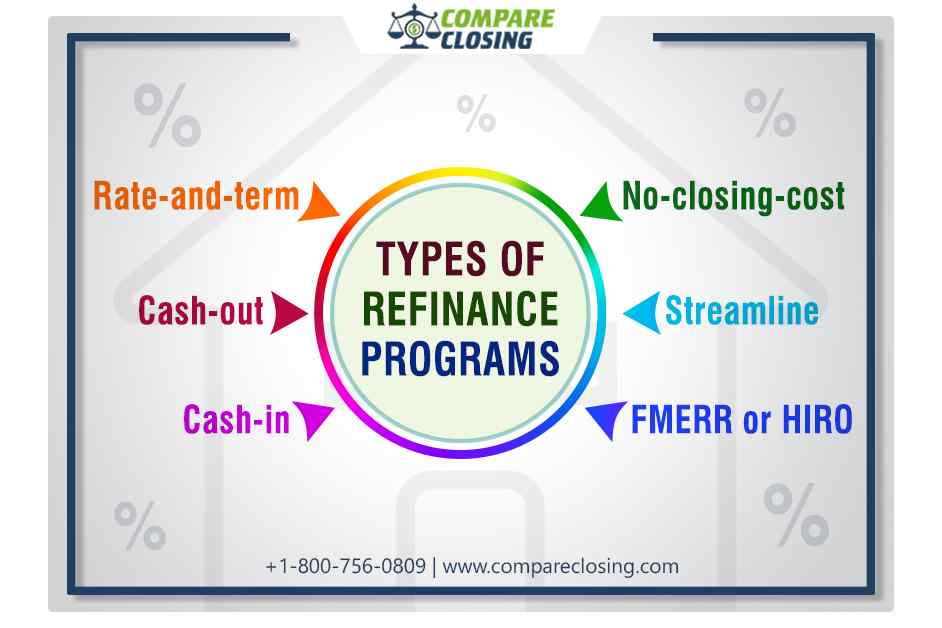

6 Types Of Refinance Programs – Find The Best Suits Your Needs

To achieve your financial goals refinancing your mortgage is one of the ideal ways. Depending on your need and eligibility there are several types of refinance you can choose from.

What Is Permanent Resident Alien In U.S.? – The Detail Guide

A foreign-born American resident who is not a U.S. citizen is a resident alien. A resident alien is someone who is a permanent resident alien or a lawful permanent resident, meaning they are considered an immigrant who has been legally and lawfully recorded as a resident of this country. To be a resident alien they must have a green card or pass a substantial presence test.

401A vs 401K Retirement Plan: What are The Differences?

401a plans and 401k plans are the two primary types of defined contribution retirement savings plans that are offered by employers. The basic difference involves the employers who offer the plan.

Pension vs 401K Plan: Find The Key Differences One Should Know

Both the 401(k) plan and the pension plan are employer-sponsored retirement plans. The major difference between both the plan is that the 401(k) is a defined contribution plan whereas the pension is a defined benefit plan.

What is Debt Restructuring? – Understanding The Process and Its Types

A process used by companies, individuals, and even countries to avoid the risk of defaulting on their existing debts, by negotiating for lower interest rates is called debt restructuring. A less expensive alternative to bankruptcy is provided by debt restructuring when a debtor is in financial difficulty, and it is a win-win situation working to benefit both the borrower and lender.

The 401k vs 403b Plan: Find The Legal Difference Between

Both 401k and 403b have taken the name after sections of the tax code, they are qualified tax-advantaged retirement vehicles offered to employees by employers. Each plan offers different investment options, but that distinction reduces over time.

What Is A Thrift Bank? The Major Advantages And Disadvantages

Thrift banks are also known as simply thrift is kind of financial institution specializing in offering savings accounts and for originating home mortgages for consumers.Thrift banks may sometimes is referred to as Savings and Loan Associations (S&Ls).

What is FIRREA – Financial Institutions Reform, Recovery, and Enforcement Act

A set of regulatory changes to the U.S. savings and loan banking system and the real estate appraisal industry is called The Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA), in response to the savings and loan crisis of the late 1980s this act was passed in 1989.

Home Equity Loan vs Refinance – The Best Guide To Differ

A home is not only a place where you live, or made an investment. Your home is a handy source of ready cash in case of emergencies, repairs, or upgrades, which can be obtained either through mortgage refinancing or through a home equity loan.

All About Mortgage Down Payment – The Unique Advantages Of It

A sum of money that a buyer pays in the early stages of purchasing a home is called a mortgage down payment. It is a portion of the total purchase price like an advance, and the buyer will often take out a loan to finance the balance.

The Pros and Cons of a 15 Year Mortgage – The Expert Overview

A 15-year mortgage is one of the popular loan terms second to a 30-year mortgage. Some borrowers opt for the 15-year mortgage because it saves them a significant amount of money in the long term.The market today is filled with several types of mortgage products.

An Expert Guide About MIBID and Other Important Factors

A synthetic benchmark interest rate used by banks in the Indian interbank market is referred to as Mumbai Interbank bid rate (MIBID). MIBID is the rate that a bank uses when it wants to borrow funds from another participating institution.

9 Different Types of Mortgage Lenders in US – One Should Know

When we go ahead with the home buying process it is confusing and a little intimidating to shop for a lender. In your home-buying research you would have seen the terms “mortgage lender” and “mortgage broker“, but their functionality and meanings are different.

What is a No Fee Mortgage? – The Comprehensive Lead

When a lender does not charges any fees for a mortgage application, appraisal, underwriting, processing, private mortgage insurance, and other third-party closing costs then it is termed a no fee mortgage.

Benefits of Hiring Mortgage Broker: A Quick Overview

A mortgage broker assists you with the application of your loans, finding competitive interest rates, and thereafter negotiation the terms. A middleman who works with you and potential lenders is called a mortgage broker.

What is a Hard Money Loan? – The Advantages And Disadvantages

A type of loan that is secured by real property is termed a hard money loan. Hard money loans are regarded as loans of “last resort” or short-term bridge loans. Primarily used in real estate transactions, the hard money loans are not transactions with the banks but with lenders who are individuals or companies.

What Is A Satisfaction Of Mortgage: A List Of Things One Should Know

When a document that confirms a mortgage has been paid off and details the provisions for the transfer of collateral title rights it is the satisfaction of the mortgage. All parties associated with the mortgage loan and collateral title must sign the satisfaction of mortgage documents that are prepared by mortgage lenders.

The Best Way to Become a Mortgage Free Faster

If these homeowners can accumulate some equity in their homes, they use up their finances again through a home equity loan or cash-out refinance to make additional purchases, or pay down their debts, or even make additional investments.

Reverse Mortgage vs Forward Mortgage – The Best Guide To Differ

A forward mortgage is a term that means traditional mortgages and the term is rarely used, except in comparison with a reverse mortgage hence you would have never heard of it. Depending on your financial situation you go with a forward or reverse mortgage.

How to Compare Refinance Rates to Get the Best Deal

Getting a low refinance rate is everyone’s desire. And to achieve it you need to have certain strategies, out of which some may work and some may not. As the rates are still hovering at historic lows, you need to find a lender who can give you their best possible deal and make your day.

How to Compare Current Mortgage Rates to Find Best Deal

According to a study conducted by Consumer Financial Protection Bureau, if the borrower had compared current mortgage rates then they would have gotten the best mortgage interest rate on average they could have saved $300 a year, or $9,000 over a 30-year mortgage.

How to Compare Current Mortgage Rates to Find Best Deal

According to a study conducted by Consumer Financial Protection Bureau, if the borrower had compared current mortgage rates then they would have gotten the best mortgage interest rate on average they could have saved $300 a year, or $9,000 over a 30-year mortgage.

SOFR vs LIBOR – The Key Differences One Should Know About

The London Interbank Offered Rate (LIBOR) is a financial standard that has had a good run with a history of close to half a century mark. But the benchmark rate is being retired by the end of 2021 for some good reasons.LIBOR has financial contracts worth $250 trillion that are tied to it,

Depreciation vs Amortization – The Differences One Should Know

Each year the cost of business assets can be expensed over the life of the asset. And to calculate the value for those business assets there are two methods – amortization and depreciation. Let us look at the key difference between depreciation vs amortization that involves the type of asset being expensed.

How does VA Loan vs Conventional Loan Differ From One Another?

When you need to decide between a VA loan vs conventional loan, a VA mortgage wins hands down because of no down payment, no mortgage insurance, and a better interest rate.When deciding between a Department of Veterans Affairs (VA) loan and a conventional loan you need to look at the following factors:

Way To Compare Mortgage Closing Costs – The Absolute Guide

Buying a home is the biggest financial decision we’ll take. While working on your numbers, be sure to budget for closing costs, which vary between lenders, states, and properties, and it can add up to thousands of dollars.

The No 1 Guide to Find Best Mortgage Broker in Texas

A mortgage broker is someone who assists potential borrowers and homebuyers get the best possible mortgage quote or plan when looking to buy a home or secure a loan. When you hire a broker, you save yourself from the trouble of going to different lenders as the broker will do this job for you.

Mortgage Lender vs Mortgage Servicer: Find Amazing Differences

Today in this post we will learn and understand about mortgage lender vs mortgage servicer and find out some amazing differences A bank or financial company that lends money to borrowers to purchase a home is called a mortgage lender.

The Mortgage LTV vs CLTV: Find the Difference

The LTV and the CLTV of your mortgages are ratios that are used to determine if a borrower is eligible or qualified for the home loan. But what do these abbreviations stand for and how are the two different from each other?

What is a Subprime Mortgage: The Pros and Cons

Borrowers who do not qualify for conventional loans because of various high-risk factors such as poor credit history, low income, and a high debt-to-income ratio are offered a loan called a subprime mortgage.

Closing Costs vs Cash to Close – The Difference

When you are buying or refinancing a home and want to know how much money you’ll need on the day of closing, then ask your lender what your total ‘cash-to-close’ number would be instead of asking him what the closing costs will be.

Comparing Home Equity Loan vs HELOC

Both Home equity loans and the home equity lines of credit (HELOCs) are loans that are secured with the borrower’s home. You can take out an equity loan or credit line if you have equity in your home. Equity is the difference between the home’s current market value and what is owed on the mortgage loan.

Bank vs Credit Union Mortgage: How to Select

Today we will see the similarities and differences between the two to help you decide which institution will be the best fit for you! Choosing between banks versus credit unions is a big decision when finding a place to store your money.

Comparing Fixed-Rate vs Variable Rate Mortgages

While mortgage shopping one of the biggest decisions home buyers and mortgage shoppers need to face is whether to select a fixed-rate or variable-rate mortgages.Many people have the question is now a good time for a variable rate?

How to Compare Mortgage Offers to Find the Best Lender

Let us talk about how to choose a mortgage lender and how to compare mortgage offers. And the best way is to go over loan estimates and break down all the numbers on the loan that you are applying for so you can choose the best way to compare mortgage offers.

How to Use a Mortgage Comparison Calculator?

It is always important to have a clear picture of all relevant costs when the time comes to compare your loans. Not only the monthly payment but also other associated costs like monthly fees, interest rates, closing costs, PMI, and others.

Comparing Mortgage Refinance Offers Effectively

They are trying to compare one mortgage versus another. You can’t just look at the interest rate, APR, or the closing costs. Comparing mortgage refinance offers is only for people who are looking to shop around for the deals.

How to Compare Mortgage Lenders using Loan Estimate in Texas

With the ever-growing competition, it is essential now than ever to make sure you have the right lending partner. The ideal way to get the best deal from the market is if you compare mortgage lenders accurately using the loan estimate.

Fixed Rate Mortgage vs Adjustable Rate Mortgage: Pros and Cons

If you are planning to purchase a new home or refinance your existing mortgage, there are always two basic options available, a fixed rate mortgage and an adjustable rate mortgage. In this post, we will compare fixed rate mortgage Vs. adjustable rate mortgage and their pros and cons that will help you know which one is better for you.

Comparing Mortgage vs Credit Card Debt

Alright! Perhaps what we need to do is explore different types of debts because a FICO score model or Vantage point model will be examining every kind of debt much differently. So when you are thinking about a mortgage vs. a credit card debt, they are definitely not equal. In today’s post, let us compare mortgage vs. credit card debts.

Difference Between Bi-Monthly Vs Bi-Weekly Mortgage Payments

You have probably heard a lot of people saying that it is a good idea to pay your mortgage twice a month. So, how exactly do you do that? What does it mean? Especially when you start considering bi-monthly Vs bi-weekly mortgage payments.

How to Get Best Mortgage Rates In Texas

When you are buying a home or refinancing, you want to get the best deal on your mortgage, and you want to make sure you get an equally good interest rate. Well, how do you do it? In today’s post, we will discuss three quick tips on how to get best mortgage rates in Texas on your mortgage and to make sure to get the best overall deal on your mortgage.

FHA vs Conventional Loans Pros and Cons

When it comes to home buying, there are many new ‘homebuyer assistance’ programs out there, Yet there are many people who are confused about whether to go for FHA or conventional loans. Both of the loan terms may sound the same when you talk to a lender, they would have similar numbers.

Buying Condominiums Vs Buying Single-Family Homes Pros and Cons

When you decide to purchase a home, there are many options for the types of homes you can buy. These options may include basic single-family homes or multi-family homes to condominiums and townhouses. We think it is imperative that you decide what kind of house you require and then start your

Comparison 15 Years Mortgage Vs 30 Years Mortgage

Buying a home is the biggest purchase you are ever going to make in your lifetime. So it depends on what kind of mortgage you get. The ideal situation is to pay for a home in cash, but a lot of people don’t have that kind of money lying around.

How to Shop for Best Mortgage Rates in Texas

It’s a no brainer that whenever you are getting a mortgage or refinancing done, you would always make sure that you get the best mortgage Interest rates. However, most of the time, people do not have an idea of how to shop for the best mortgage rate.

Steps For Mortgage Shopping In Texas

Today let us discuss one of the most important topics in the home buying and refinancing experience. If you are putting effort to research before buying a new car, a television, mobile phone, or something as simple as shoes

4 Ways To Select The Right Mortgage Lender in Texas

Selecting the right mortgage lender in Texas could be a task. There are many mortgage loans in the market, like FHA, VA, USDA, Conventional, Jumbo, etc.If you are looking to get a mortgage or to refinance your existing mortgage,

The Top Reasons for Comparing Mortgage Quotes In Texas?

There are many mortgage quote comparison tools available online which help you to comparing mortgage quotes in Texas.It is now important than ever to compare and shop around for the best interest rates in the market due to the competitive nature of the business.