Table of Contents

- What Are Netting Escrows & How Does It Work?: The Best Guide - January 2, 2024

- The Secret About Prescriptive Easement: Top Guide 1 Must Know - December 4, 2023

- About Home Equity Loans In Texas And How Can One Obtain It - November 27, 2023

Introduction to Mortgage Refinance

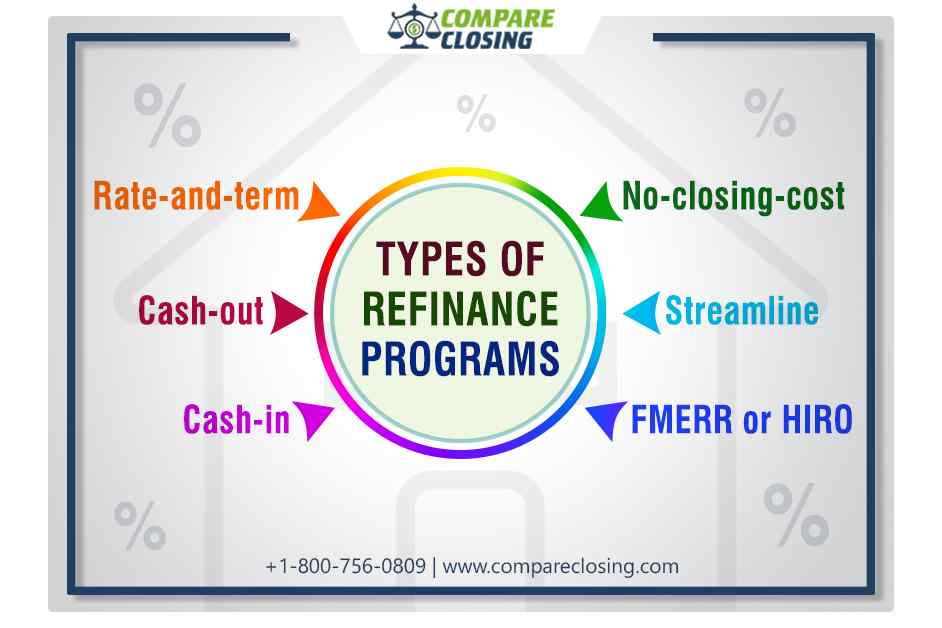

To achieve your financial goals refinancing your mortgage is one of the ideal ways. Depending on your need and eligibility there are several types of refinance you can choose from.

Different Types of Refinance Programs

I - Rate-and-term refinance

A rate-and-term refinance is a regular refinance which replaces your current mortgage with a new one and it has different terms. You can change your interest rate and monthly payments, and you can refinance into a new term length.

Conventional, FHA, VA, and USDA mortgages are eligible for rate-and-term refinancing. TO qualify for the refinance a borrower would need a certain credit score, debt-to-income ratio, and amount of equity in their home which will depend on which type of mortgage they already have.

For instance, borrowers can do a rate-and-term refinance from an FHA mortgage into another FHA mortgage, or they can opt to switch from an FHA mortgage to a conventional mortgage.

II - Cash-out refinance

Another type of home refinancing program is a cash-out refinance, where the borrower will replace their old mortgage with a new mortgage that has different terms.

But in this case, they will take out a loan larger than what is left to pay on the home so they can receive the surplus amount in cash.

If the borrower has built equity in their home then a cash-out refinance can be a good option. Usually, enders approve of only 80% of the home’s value in cash, so the borrower would need a minimum of 20% equity in their home.

For instance, if the home is valued at $250,000, and the borrower has $125,000 left to pay on their initial mortgage. It would mean they can have $125,000 in home equity or 50% of the home value.

If the borrower wants to keep 20% of their equity in the home, then they are eligible to take out 30% of the value in cash, or $75,000.

They can take out a loan of $200,000 — that’s $125,000 that they already owed on the home and $75,000 in cash.

Conventional, FHA and VA mortgages provide cash-out refinance options, but this option is unavailable for USDA mortgage refinancing. To receive cash, borrowers can refinance from a USDA mortgage into a conventional mortgage.

III - Cash-in refinance

When a borrower applies to refinance their mortgage, most lenders want them to have at least 20% equity in their home. In other words, so the borrower’s loan-to-value ratio must be 80% or less.

And if the borrower doesn’t have 20% equity in their home yet, but they want to refinance to lock in a better mortgage rate or lower monthly payments then they can take advantage of a cash-in refinance.

In a cash-in refinance, the borrower makes a larger payment toward their principal to lower their LTV ratio.

For instance, if an appraiser looks at the home and declares its current value to be $250,000 and if the borrower still owes $237,500 on your mortgage. So the LTV ratio is 95%, meaning the borrower has 5% equity in the home.

They can do a cash-in refinance and pay $37,500 all at once to lower their principal balance to $200,000. Now the LTV ratio is 80% and the borrower has 20% equity in the home, and thus they qualify to refinance.

Cash-in refinances do not apply only to homeowners who need help qualifying to refinance. A borrower may decide to do a cash-in refinance to lower monthly payments or lower their LTV ratios to qualify for better rates.

IV - No-closing-cost refinance

A borrower may not be prepared to pay thousands in closing costs during refinancing. So a no-closing-cost refinance allows them to refinance into a new term with a new rate, and they don’t need to pay a lump sum at closing.

The borrower may not be paying closing costs upfront, but they will still pay the money over time because the lender finds another way to charge them.

There are two ways a borrower could be paying closing costs – Either the cost is rolled into the mortgage, or they pay a higher interest rate.

V - Streamline refinance

With a streamlined refinance, a borrower can refinance their mortgage without going through an appraisal. In many cases, they would not need their credit scores, their DTI ratio, or proof of income.

If a home has lost value then streamlining is a good option, because the lower value will not affect the borrower’s chance of being approved or receiving a good rate.

It could also be useful if the borrower’s finances aren’t as strong because anyways the borrower doesn’t need to show their credit score or debt.

Borrowers can streamline refinance their government-backed home loans like mortgages through the FHA, VA, or USDA, but conventional mortgages cannot be streamline financed, because the borrower is refinancing from one type of mortgage into the same type again.

For instance, they would be refinancing from an FHA loan into another FHA loan.

VI - FMERR or HIRO refinance

If the borrower has a conventional mortgage but doesn’t have enough equity to qualify for a regular rate-and-term refinance.

Then they can opt for the Freddie Mac Enhanced Relief Refinance (FMERR) and Fannie Mae High LTV Refinance Option (HIRO) programs.

Both of these programs let a borrower refinance even if they have less than 3% equity in their homes. Even if they are underwater on their mortgage, (where they owe more than their home is worth) they can qualify.

The borrowers can apply for the FMERR program only if their original mortgage is backed by Freddie Mac, and HIRO if it’s backed by Fannie Mae.

Conclusion

Different types of refinance have different qualification processes and requirements. Some require the borrowers to have a strong financial profile. Some types of refinancing loans the borrower against their home’s equity.

The type of refinance one chooses will come depending on which type of loan they currently have, their qualifications, and their financial goals.

Amanda Byford

Amanda Byford has bought and sold many houses in the past fifteen years and is actively managing an income property portfolio consisting of multi-family properties. During the buying and selling of these properties, she has gone through several different mortgage loan transactions. This experience and knowledge have helped her develop an avenue to guide consumers to their best available option by comparing lenders through the Compare Closing business.